Learn a NEW STRATEGY to match your TRADING STYLE!

Spreading one stock against another (such as Coke vs Pepsi) is a tried-and-true hedging strategy many firms have an entire trading desk devoted to. An even more interesting, predictable and consistent strategy is trading one index against another. One of the best “pair” trades is the SPX (SPY) against the QQQ.

The largest stocks that make up the SPX/SPY are the same that make up the QQQ index – AAPL, MSFT, AMZN, NVDA, GOOG, etc. This makes for a high degree of correlation and predictability between the two indexes. Obviously, the cost of buying and selling indexes can be prohibitive. Futures have their own complications associated with it. Creating a PAIR trade with options, however, can be used to customize any risk characteristic and directional bias you can image or desire.

Explore all the possibilities of this powerful strategy with the full 10-hour recording and bonus classes, and master a a totally unique way of minimizing risk while creating opportunity.

$799 price includes:

- Class Recordings (~10 hours)

- Handout of Class Slides

- Put/Call Worksheets

- Introduction to Pair Trades Write Up

- Actual 3-Leg Box Example Applicable for Alchemy, Day Trading, Hedging and Closing Positions

- Bonus Class Recordings:

- Student Questions

- ViPars and ViPars Repair

- Success and Jelly Roll

In the medieval times, Alchemy was the science of trying to turn base metals (lead) into noble metals (gold). This was the precursor to what we now know as Chemistry. We are doing the same thing in our Alchemy Trades. Starting with a trade that has risk, you will learn how to add a different spread to end up with a position that is golden. This is how successful floor traders hone down risk in a sophisticated manner to increase profit potential and lower risk/cost.

This course focuses on existing trade's adjustments. One of the most challenging things a trader goes through is deciding when to close a trade regardless if the trade is working in your favor or going against you. Even a profitable trade is difficult to manage at times because the trader is not sure how far to press his luck, balancing additional profit against giving back some profits.

For both trades working in your favor and going against you, Alchemy teaches many ways to adjust an existing position. Both financially and emotionally knowing how to pare down a trade to harvest profits while at the same time keeping a portion of the trade on in an attempt to make even more profit is the difference between failure and success.

Often in our POT classes, we remind people that in a room of traders can all be given the same position that is losing money, the professional trader will often find a way to break-even or make a profit, while the novice to intermediate traders will take a loss.

$799 price includes:

- Class Recordings (~10 hours)

- Handout of Class Slides

- Alchemy Spreadsheet

- Actual 3-Leg Box Example Applicable for Alchemy, Day Trading, Hedging and Closing Positions

- Bonus Class Recordings:

- Call Spread = Put Spread

- Box Spread

- BWB and Unbalanced Set-Ups

- Moving Positions when Caught in an Unbalanced Condor and Stuck-Alchemy

0DTE day trading has become a very popular trading strategy for people, but we recommended for new traders to hold off until intermediate level is reached. There was such a demand for learning the process that we held a 2-day mini class on this subject.

It was important to show the difference between gambling and sound trading decisions, how to handle losses, not get overly emotional, spread off risk, etc.

This class concluded with what we term “creating a tent” where we have a potential profit graph everywhere within that day's expected range.

$799 price includes:

- Class Recordings (~7 hours)

- Live Market Class Recordings (~8 hours)

- P.O.T. Class Live on Day Trading(~5 hours)

- Handout of Class Slides

- Trading Spreadsheet

- Actual 3-Leg Box Example Applicable for Alchemy, Day Trading, Hedging and Closing Positions

- Bonus Class Recordings:

- Greek and Unbalanced Birds

- Box Spreads

- Hedging with Futures

- BWB and Unbalanced Set-Ups

- Student Questions

- Making Markets

This mini class is a great start for understanding Volatility Pairs trading. The Vipars™ mini-class covers everything needed to implement the strategy and is not a teaser to sell other product. For more information on Vipars™, read more about the strategy here.

It is a short term trade that is usually held from 1-10 days, depending on market conditions. It is a spread between the VIX (Volatility Index) and the SPX, and is an excellent tool to implement when the markets are falling apart.

Many times a year the market will fall fast and hard. The fear and panic that ensues causes traders to not know what to do. Some people want to buy stocks at a discount compared to the price they were at the previous day; however, they worry about buying it too soon if the market is still falling more. This uncertainty causes paralysis on most traders not knowing what do do in these market conditions, but the ViPar ™ is the perfect strategy.

We will sell the overbought VIX and hedge that sale with an SPX spread in case the fear gets worse. Then we just wait for things to calm down, which they always do, and close the trade for a large potential profit.

Many students start here and if they have huge success with the strategy and want to specialize in this powerful strategy, then they can always contact the office to upgrade to the full 3-day package.

$999 class only price includes:

- Class Recordings (~13 hours)

- Handout of Class Slides

- Write up on a live trade example

- Bonus Class Recordings

- Live Market Class on Synthetics

- Students' Mistakes

- Additional Cost: Text book "Taking a Bite Out of Volatility Pairs" ($999)

Unbalanced Birds is a collective name for BWBs, Unbalanced Condors, unbalanced butterfly spreads, etc. This is THE class on unbalanced birds and the physics behind making it a successful strategy, especially for 0- and 1- DTE trades.

These are excellent short term strategies that take advantage of an option trader's best friend (or worst enemy if on the wrong side) – time decay. They also are pretty safe against most intra-day and overnight moves. This is a must have class for anyone serious about making money with overnight and same-day “risk-spreads” designed to take advantage of the time decay curve. Covering every details from entry, maintenance, adjustments, and closing—nothing is left out.

$599 price includes:

- Class Recordings (~7 hours of instructions, ~2 hours of preparatory class)

- Handout of Class Slides

- Unbalanced Birds Criteria Write Up

- Case Study Examples

- Post Class Example

- Bonus Class Recordings:

- Unbalanced Birds

- Unbalanced Condors

- BWB and Unbalanced Set-Ups

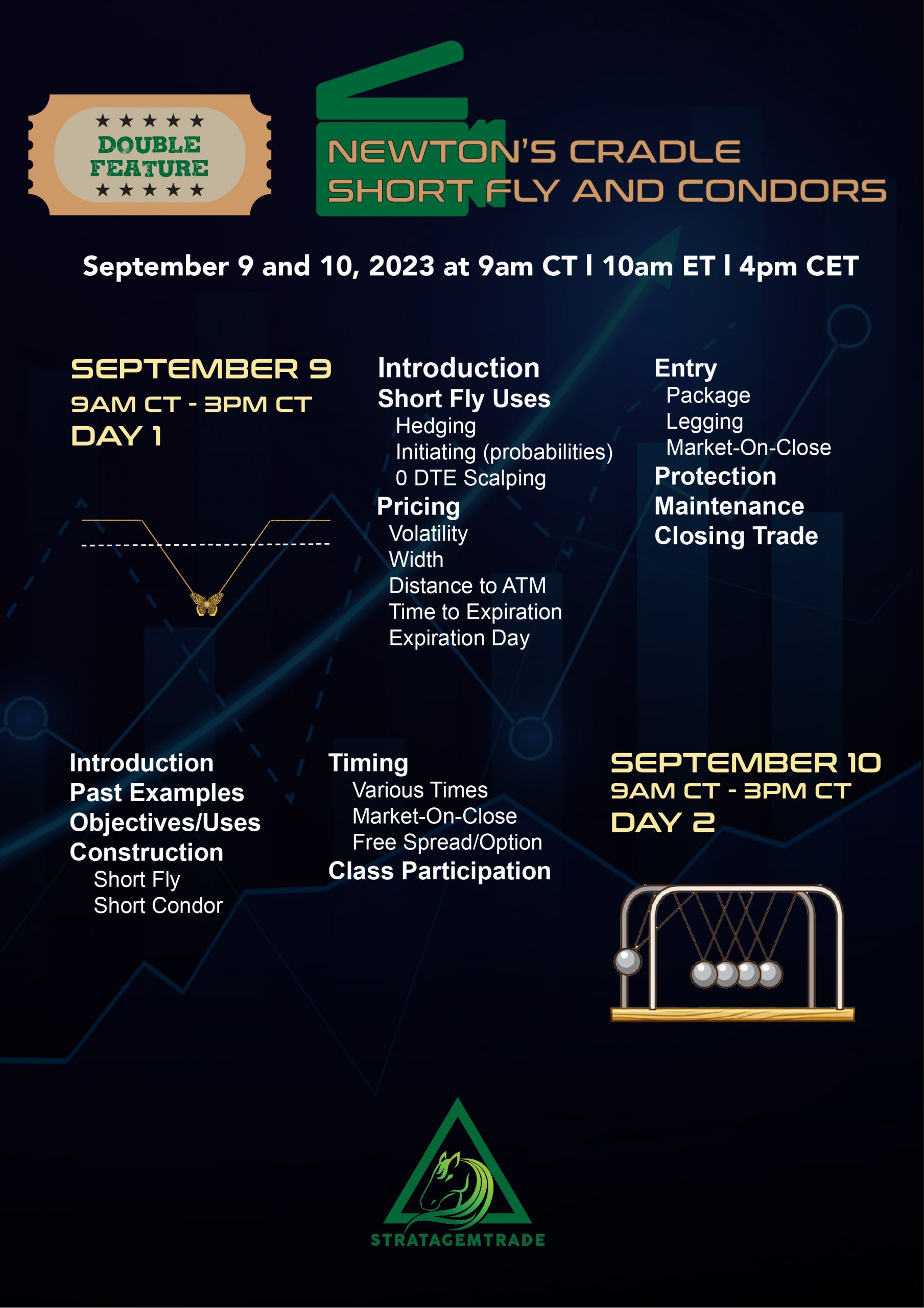

When you see a short butterfly being hedged with a cheap vertical spread and the risk-graph goes from have large risk to no-risk and a long vertical at completely different strikes, it looks like a Newton's Cradle game.

Creating a short butterfly (or condor) can be a very favorable alternative to closing out a vertical spread that is moving the wrong way.

$799 price includes:

- Class Recordings (~12 hours)

- Handout of Class Slides

- Bonus Materials: Three-Legged Box Example (7 pages) and Layer Spreads (17 pages)

- Bonus Class Recordings:

- New Game Plan

- Live: 3-Legged Box

- Box Spread

- Newton's Cradle and Short Fly Primer

- Advanced Butterfly Sale

- Practical Short Fly Example

This mini class will take you on a purposely led path from remedial through professional level collars, including the popular Triple Threat/Triple Return Method (CIS: Call Instead of Stock) and Five-Year Millionaire (5YM) strategies. Regardless of your level of sophistication, there will be new stock (and stock substitute) strategies to learn.

This is a class that teaches many different entry and hedging techniques to stock ownership, as well as alternatives to stock ownership such as the CIS (call-instead-of-stock). The downside to owning a stock is the cost and using an ITM call to replicate the movement of a stock can reduce entry cost by 75%.

It also talks about the 5-Year Millionaire strategy that Scott developed for stocks. This is turning the traditional collar inside-out and is designed to focus on the shorter-term trading of a collar.

$799 price includes:

- Class Recordings (~20 hours: two days of instruction, 3rd class on Q&A, a POT class on Dynamic Hedging)

- PDF of Class Slides

- Call Instead of Stock eBook (30 pages)

- Five-Year Millionaire Example, Worksheet and eBook (45 pages)

- Other Materials Distributed in Class

- Bonus P.O.T. Classes:

- Collars Strategies Mini Class Primer

- Shorting the Dividend Pool

- Call Instead of Stock

- Five-Year Millionaire

- Two (2) Additional P.O.T. classes on Dynamic Hedging

Long Term Collars Trade (until 12/31/24)

The Class: STOCKS AND COLLARS

Every year in Scott's POT class he studies at least one collar position for a few months. This time around, the is doing a full 6-month project that comes with him doing a complete journal on the whole trade over the course of that 6 months. On February 16, 2024, Scott started a long-term collar on a stock (MRO) picked by the students through a vote. He will be managing the trade every day for six (6) months. As the trade progresses, he will be keeping a daily journal that will be printed and will be provided to subscribed students as a book at the conclusion of the class.

DYNAMIC HEDGING: The Dynamic Hedging of a Collar is one of the most elegant and intricate events in protecting a stock given the near limitless setups that can be done. Furthermore, the hedges will need to be adjusted and carried along with the stock in order to maximize upside potential, use the puts to buy more shares, and maintain proper downside protection.

CALL: There are times when selling a call is called for and times when a call spread (sale) or no sale is preferable.

PUT: Depending on volatility levels and time until expiration, a butterfly, broken-wing butterfly (BWB), condor or vertical spread is preferable to owning a long put. As a matter of fact, there will be times when owning less puts offers more downside protection than being fully hedged. You heard that right. Though it does not logically make sense, we will be demonstrating such instances. During times of an extreme collapse in the share price of the underlying, the ITM put can be used to purchase more shares without further out-of-pockets costs/investment capital. Who else teaches this?

COMBINED: Over the course of 6 months, we will be having at least one (1) POT class a month dedicated to just the collar. This is going to be the MOST comprehensive Collar class we (or anyone) have ever done, and a must for anyone who owns shares they wish to protect.

$858 price includes:

- Access to a dedicated Collars Mini P.O.T. Slack channel updates of the trade examples

- P.O.T. updates regarding the Collar trade example(s), sent via email; includes Scott daily journal entries

- At least six P.O.T. class recordings that pertains to Collars

- Introduction P.O.T. class recording done on February 7 plus access to the live class on February 15 (and the recording)

- Scott's complete journal (printed copy) at the end of the 6 months

- Final bonus P.O.T. class wrap-up recording

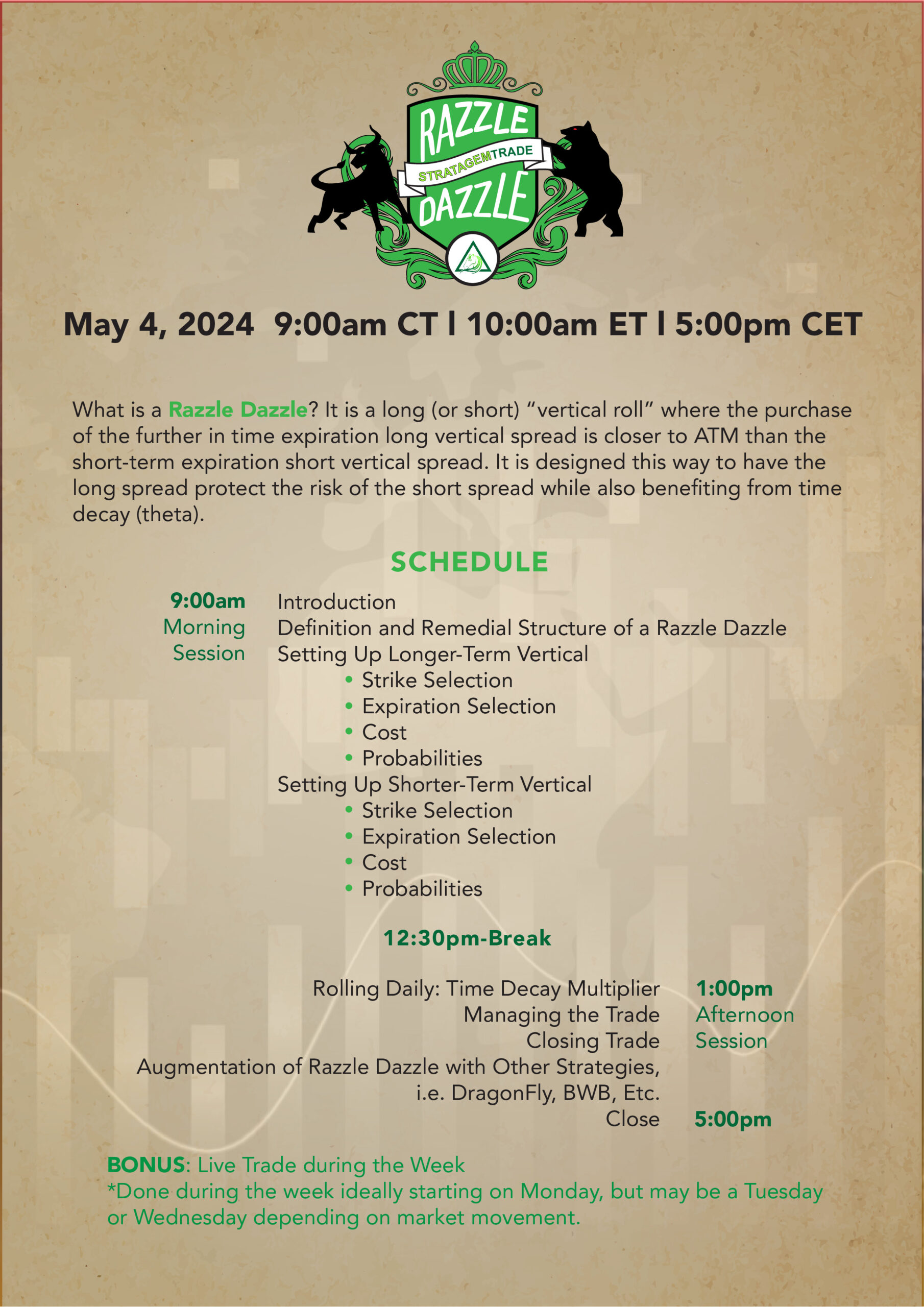

A Razzle Dazzle (RD) is simply a long (or short) Vertical Roll where the purchase of the further in time expiration long vertical spread is closer to ATM than the shorter term expiration short vertical spread.

It is designed this way to have the long spread protect the risk of the short spread while also benefiting from time decay (theta).

$549 price includes:

- Class Recordings (~7 hours)

- Handout of Class Slides

- Bonus Class Materials: Write Ups on Volatility Skew, Criteria

- Bonus P.O.T. Classes

- Razzle Dazzle and Skew and Rolling Advanced

- Razzle Dazzle Bonus and New Rules

- Example 34 & 35 Clarification of Razzle Dazzle

- What is Razzle Dazzle?

- Adjustments and Key to the Razzle Dazzle (2 classes)

A Risk Reversal is perhaps the ideal strategy for a directional trade that is more forging than a long option or vertical spread. By strategically placing a long vertical call spread and a short put spread (or the reverse), traders mitigate volatility, skew and time premium risk associated with a directional trade such as a vertical spread, while allowing a huge room for the market to move in the wrong direction without a loss. That doesn't happen with a long call or put spread.

The key to this trade is the correct selection of strike prices, width of vertical spreads, expiration dates, and adjustment/hedging techniques. Perhaps this is why so many large traders and firms use this strategy as a speculation and hedging tool.

This is a strategy we are going to be using very often in POT classes during this low volatility environment that is frustrating most traders. Why? It can implemented in any market condition, and it ideal for overbought and over sold market conditions.

$699 price includes:

- Class Recordings (~7 hours)

- Handout of Class Slides

$999 price includes:

- Above inclusions and Advanced Risk Reversal Textbook

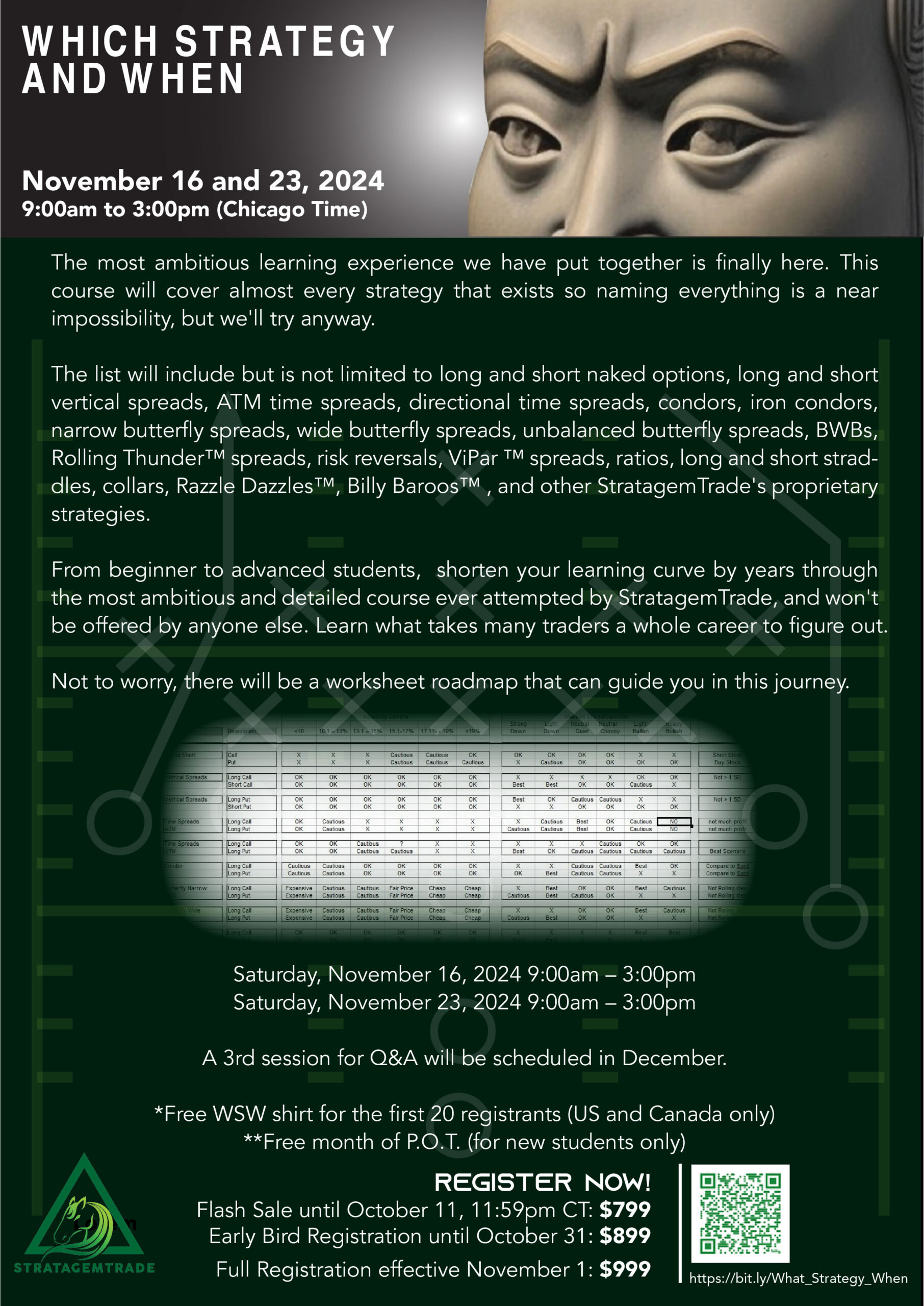

The most ambitious learning experience we have put together is finally here. This course will cover almost every strategy that exists so naming everything is a near impossibility, but we'll try anyway.

From beginner to advanced students, shorten your learning curve by years through the most ambitious and detailed course ever attempted by StratagemTrade, and won't be offered by anyone else. You want to get into a seasoned trader's mind? You are in the right place.

Not to worry, there will be a worksheet roadmap that can guide you in this journey.

$999 price includes:

- Class Recordings (~13 hours)

- Handout of Class Slides

- Which Strategy When Matrix with Footnotes

- Supplemental P.O.T. Classes (15)

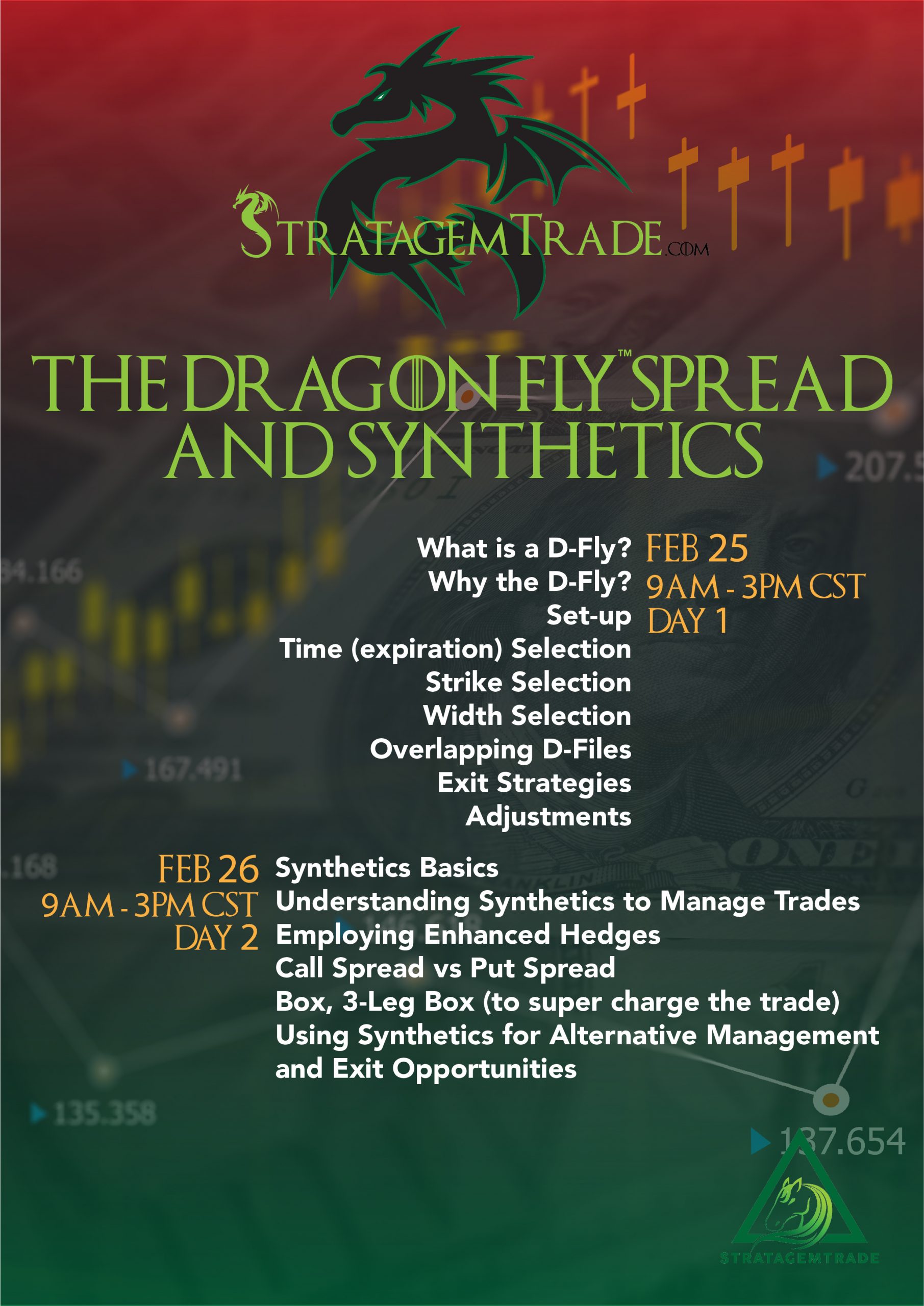

- Short Butterfly and Condor, Rolling Thunder, Ratio Spreads, Gamma Scalping, Dragon Fly Criteria, Morning Jelly Roll, Dragonfly vs Butterfly, Diagonal Spreads, Baby Vipars, Pair Trades, Unbalanced Birds, Newton's Cradle, Long Term Alchemy, What is Razzle Dazzle?

- Short Butterfly and Condor, Rolling Thunder, Ratio Spreads, Gamma Scalping, Dragon Fly Criteria, Morning Jelly Roll, Dragonfly vs Butterfly, Diagonal Spreads, Baby Vipars, Pair Trades, Unbalanced Birds, Newton's Cradle, Long Term Alchemy, What is Razzle Dazzle?