Mini Courses

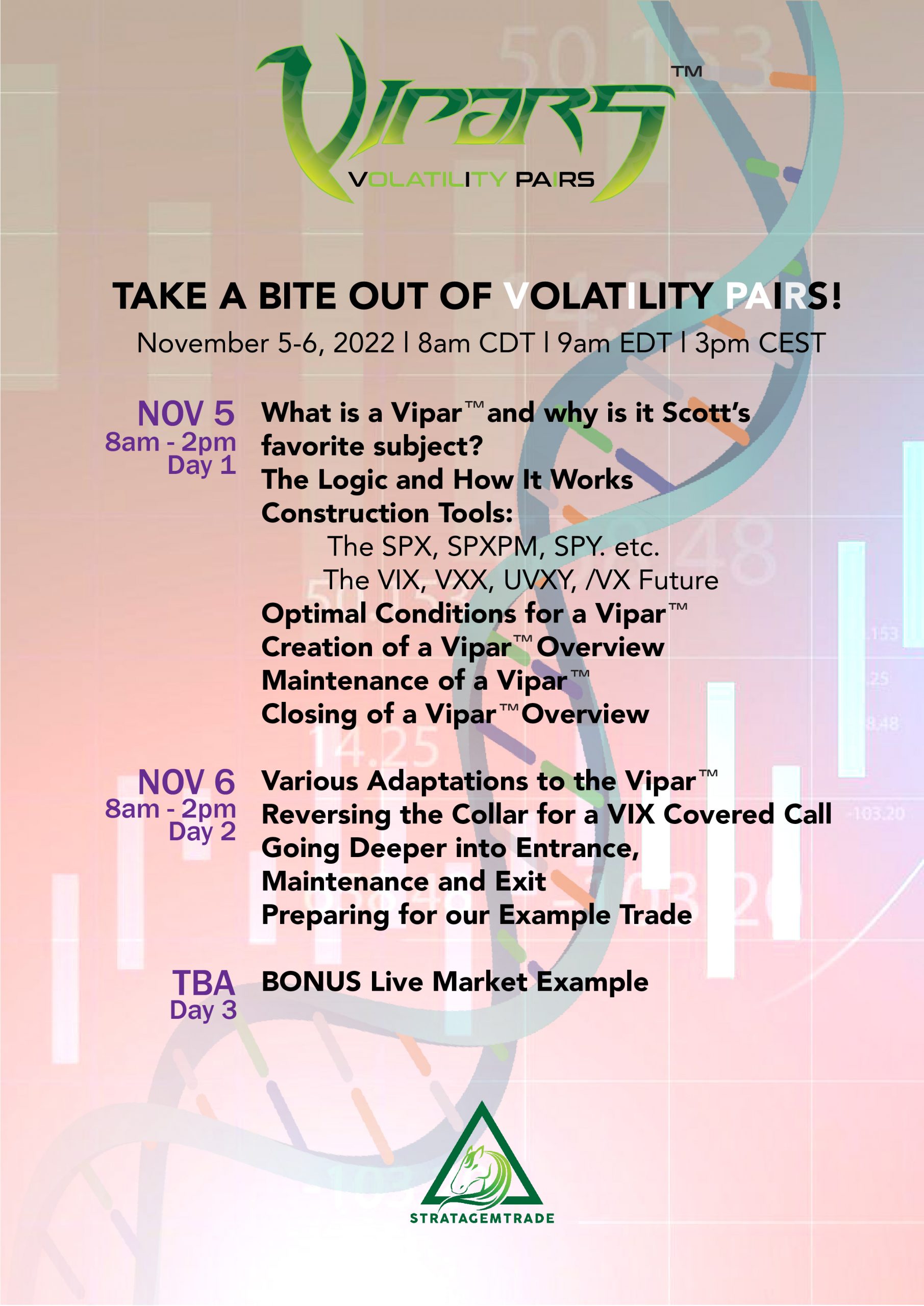

Stratagem Trading offers one or two day courses (4 to 8-hours per day) on specific topics and/or trading strategies from time to time. These courses are designed to address and prepare for anticipated market events (such as the Crash Ready course), or to present in-demand strategies, which maybe of interest to a wider public audience. Topics range from basic to advanced.

Why take this class?

Starting the year 2025 out strong, StratagemTrade is attacking arguable the best method to hedge a portfolio of stocks very few know how to do. Honestly, you are not hearing about this anywhere else, are you?

Warren Buffett doesn't want you to know about it – he wants you to buy his stock (Berkshire) instead.

This intensive 7 hour day covers everything from the remedial to intermediate.

This is such a powerful and popular topic that Scott had his largest audience at Northwestern University when teaching this topic.

Warren Buffett and Coca-Cola.

People think Warren Buffett is successful at being the world's best stock picker, but this is far from the truth. After selling out much of his AAPL shares, Mr. Buffett's largest stock holding is Coca-Cola (KO).

Scott

aka J.L. Lord

Scott (aka JL Lord) is a retired floor trader (CBOE) with over 20 years of extensive experience and expertise in leading others in their trading education journey on the subtleties of stock, commodity, currency, index and option trading.

He rose to prominence as the lead instructor/head trader for option education companies such as TradeSecrets, Optionetics, and Random Walk. His many accolades and accomplishments include authoring over 15 books, textbooks and course manuals under the nom de plume J.L. Lord.

Over the last 2-years the stock market is higher by more than 50%, and Coke is lower. Then how do you explain his consistently outperforming the market? Those secrets are taught in the class, and will be easy to understand and replicate by those in attendance.

HEDGED

This is a hedged strategy, but in many/most ways beats the traditional equity collar. Even in crisis you are safe. Google “who made the most money in 2008 financial crisis” and you will see it the names John Paulson, Michael Burry, and Warren Buffett come up. While others were panicking and selling stock, Buffett was selling his hedges and buying $5 billion of Goldman Sachs, $3 billion of GE, shares in Dow Chemical and he bought Burlington Northern railway (BNSF) for $26 billion.

CLASS

Starting at 9am on Saturday January 28 the class will hit the ground running in the most organized and linear MINI CLASS StratagemTrade has ever had. This class is for anyone and everyone who owns stocks and is planning out their long term goal of handsomely beating the markets, taking advantage of the power of compounding, and being hedged against disaster at the same time.

Seating is limited to 100 people on a first come – first serve basis. As always, the price will go higher after the class. Based on the enthusiasm from people, this will be the most popular and affordable class of 2025. This topic is the “secret sauce” so many students are searching for that we are also dedicating the first 6-months of COLLARS P.O.T class to this one trade and an example.

And in keeping with Mr. Buffett's tradition of giving, a portion of revenues will go to charity.

Schedule

Saturday, January 25, 2025 9:00am – 4:00pm CST

Included

One full day of class instructions, access to class recordings and PDF copy of slides.

Supplemental P.O.T. class recordings

*Free 30-day free trial of P.O.T. class (new students only)

Register Now!

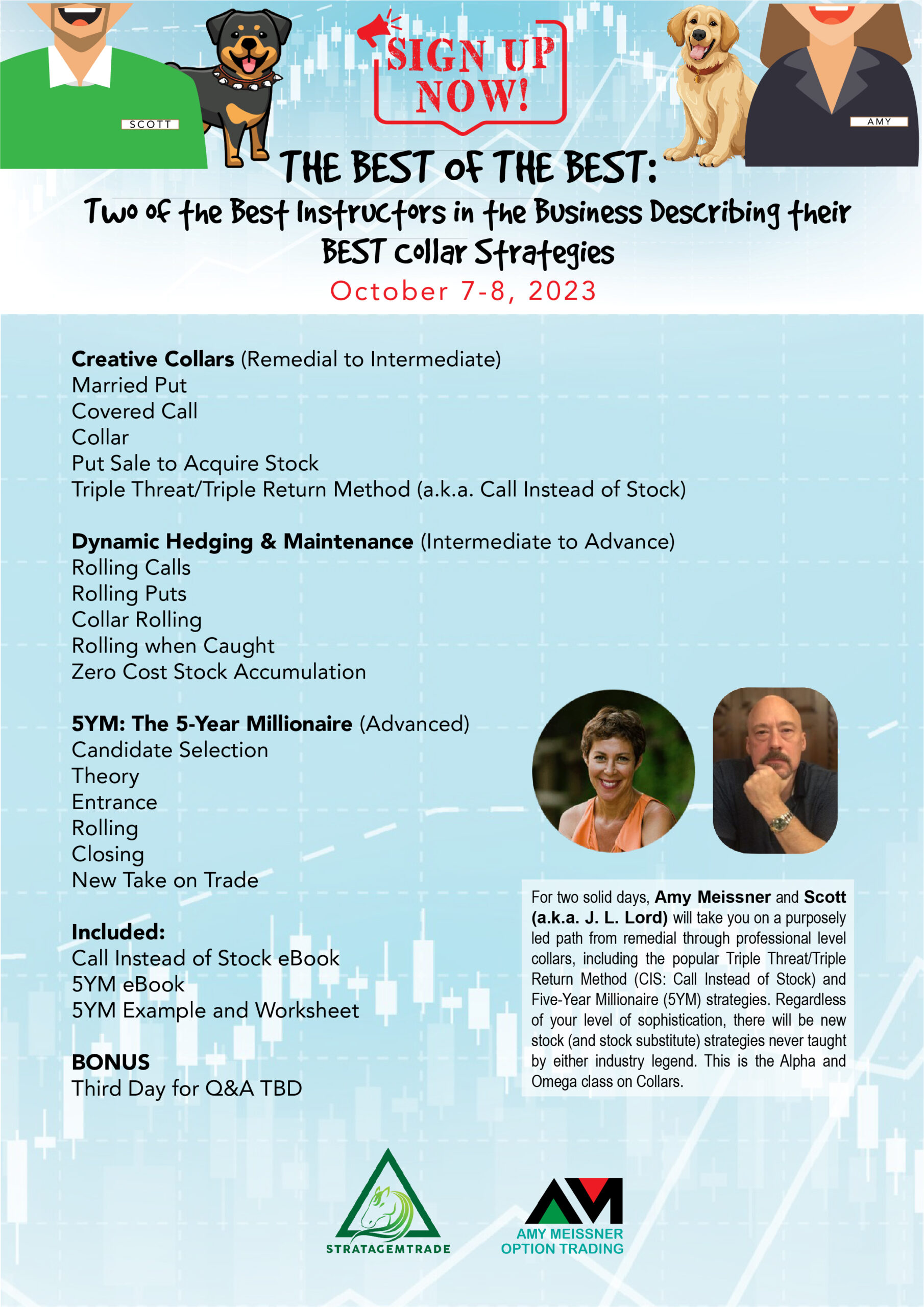

LEARN A NEW STRATEGY THAT MATCHES YOUR TRADING STYLE!

For more information, CLICK HERE.