Mini Courses

Stratagem Trading offers one or two day courses (4 to 8-hours per day) on specific topics and/or trading strategies from time to time. These courses are designed to address and prepare for anticipated market events (such as the Crash Ready course), or to present in-demand strategies, which maybe of interest to a wider public audience. Topics range from basic to advanced.

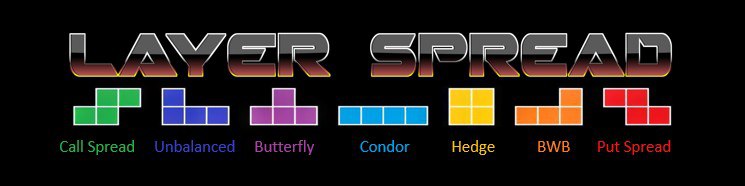

What is a Layer Spread?

This is one of the most consistently successful strategies we have used over the last 15 years, yet we have not had a full length class on its dynamics.

A Layer Spread is a Tetris game of combining multiple and varying strategies to construct a “no-lose” final position. After the initial spread (foundation), each subsequent trade stacks layers on top of layers to continuously increase profit potential and lower risk.

There is a half day BONUS class on February 7 to add more material and cover any questions that may come in after the class.

Scott

aka J.L. Lord

Scott (aka JL Lord) is a retired floor trader (CBOE) with over 20 years of extensive experience and expertise in leading others in their trading education journey on the subtleties of stock, commodity, currency, index and option trading.

He rose to prominence as the lead instructor/head trader for option education companies such as TradeSecrets, Optionetics, and Random Walk. His many accolades and accomplishments include authoring over 15 books, textbooks and course manuals under the nom de plume J.L. Lord.

Stratagem's students love this strategy that is constructed by taking their own favorite strategies and deliberately stacking them in key areas. Whether the trade is done for a 1-day, 1-month or 6-month expiration cycle, the goal is to create a PNL graph that can't lose money over the longest range of prices possible (like this 6450 through 7,000 SPX range).

Asking to see the evolution from single cell (Risk Reversal, Unbalanced Condor, etc.) to complex life form was easy when understood and broken down in stages. This 54-second video shows the 6-week evolution where a simple trade emerged from the ocean to walk upright.

Schedule | Class Outline

Saturday, January 31, 2026

10:00am Introduction

10:30am What is a Layer Spread

11:00am Construction: High Volatility, Medium Volatility, Low Volatility

Equities

12:00pm Layer One

Layer Two – Home Free

2:00pm 15-minute Break

2:15pm Moving Clay Around to Create Tent

4:00pm Maintenance

5:45pm Questions to Prepare for February 7 Class

6:00pm End of Day 1

February 2 – February 6: Ideally Start a Layer Example

Saturday, February 7, 2026

8:30am Questions Addressed

9:00am Closing Down Trade or Morphing into a New One

11:30am End of Day 2

Included

- 1.5 days of class instructions

- Access to Class Recordings

- PDF copy of slides

- Layer Spread Example During Market Hours

- Supplemental P.O.T. Class Recordings

- Free 30-day Trial of P.O.T. Class (*For New Students Only)

Frequently Asked Questions

- How different is this from Alchemy (which I have)?

Answer: Apple and bananas. Both are fruits but with vastly different flavors, and the same is with the Layer Spread.Alchemy is one of our most loved and popular products. People who have never heard of the StratagemTrade are somehow talking about an "Alchemy adjustment”. The Layer Spread, however, is a strategy where we deliberately set out knowing that we will be adding to an initial trade (often more than once), whereas an Alchemy is almost always a way of repairing a broken trade or taking profits.

Alchemy may be adding a new trade, but it is an adjustment to slowly shut down a position, where in Layer Spread, we are adding to the position to gain more profit potential and lower risk. - Scott said in a POT class that the layer spread can be adapted for different time horizons. I live in Asia. Is it possible to check the trade at a fixed time once a time and only do adjustments at this time?

Answer: People who have limited time in watching the markets (by choice or design) are ideal users of the Layer Spread. After the first adjustment you can be as relaxed or proactive as you want. As an example, in the last Layer Spread example we did in POT, there was a 3-day change between our first and second layer. From there, we had 1 month and 1 week for the next layer. Then we had 2 days after that. Had we missed one of the adjustments the trade would not have been as profitable, but we would have still made money. - I cannot open a TOS account where I am from. Will a rudimentary analysis tool such as Tasty Trade's or Optionstrat suffice?

Answer: I am not familiar with every trading platform out there, but Tasty Trade would certainly work. This is not a strategy that needs a race horse trading platform. - How easy is it to apply what I will learn in this class? Some of Scott's stuff is really deep. I understand them at an intellectual level but the application is another thing.

Answer: This is probably the best question about the class I have received yet. I do not want to over promise or mislead. Having said that, I honestly believe that anyone that understands Alchemy (even with a struggle) will have much less trouble with Layer Spread. Like in math where people find it easier to add than subtract, Alchemy is about subtraction and this is like addition. About 95% of students will be able to understand it, even if it requires watching parts of the recording a couple of times.

In addition, while I am doing the BONUS TRADE for the class, I will be going into great detail in explaining every step to make this a learning tool.

LEARN A NEW STRATEGY THAT MATCHES YOUR TRADING STYLE!

For more information, CLICK HERE.